INTRODUCING: TIBE

One Power offers TIBE investment opportunities to companies and high net-worth individuals who can effectively utilize the tax credits that our Wind for Industry projects generate.

TIBE is tax equity made simple.

WHAT’S ON THIS PAGE?

One Power offers TIBE investment opportunities to companies and high net-worth individuals who can effectively utilize the tax credits that our Wind for Industry projects generate.

TIBE is a phrase invented by One Power to distinguish its unique structure from the broad class of tax equity.

TIBE is One Power’s unique approach to tax equity. We like to think of TIBE offerings as net income investments that put the I&T in EBIT first (after all, TIBE is “EBIT” spelled backwards).

Tax Equity in 100 Words:

Certain investments generate large tax credits. These tax credits produce so much tax value that the company generating these credits – a company building a wind farm, for example – cannot fully utilize the value. Instead of wasting the tax credit, the company creates a structure to partner with a larger company that can actually utilize the tax credit.

The small company keeps the cash, and the big company gets the tax value. Instead of paying taxes, the big company invests the money they would have paid and gets a mid-to-high-teen return on money that would have instead been “wasted” paying taxes.

In 100 words, tax equity seems simple – but most modern tax equity has become a lucrative and highly financially engineered structure, mired in complexity and protectionism by major companies and huge law firms. Most transactions have become so complex that you need a nine-figure deal size just to compensate for the transactional inefficiencies. That is why you probably haven’t heard of tax equity. But TIBE offerings from One Power are different.

TIBE is a highly simplified and highly standardized version of tax equity that eliminates risk and complexity, and in doing so creates more shared value for projects of this scale.

We give our investors far more value than traditional tax equity structures and still raise more net capital due to the lower transaction costs.

Target Investors

The target audience for TIBE investments is one of the following:

1. Public or Widely Held Corporations (WHCs) with an annual tax liability in excess of $5,000,000.

2. Closely Held Corporations (CHCs) with an annual tax liability in excess of $5,000,000. This includes LLCs that are taxed as corporations. (Note that CHCs can utilize the tax credit against active income, but there are some nuanced limitations that must be discussed to ensure the full tax value of the investment can be utilized.

3. Family offices or High Net Worth Individuals that have enough passive income to utilize the credits and loss allocations against their passive income.

4. LLCs taxed as Partnerships or Partnerships that have enough passive income to utilize the credits and loss allocation against their passive income

Contact us to get on our list to be the first to know when TIBE opportunities become available.

Our TIBE Private Placement Memoradum

Please note that this PPM is a redacted template.

How TIBE Works

To fully understand how TIBE works, you’ll want to read our Private Placement Memorandum .

Each of the Wind for Industry projects that One Power develops enters into a 20-year contract, providing fixed-rate power to a customer. Each project is also eligible for accelerated depreciation and the Investment Tax Credit.

TIBE is an investment that consists of purchased interest in a limited liability company taxed as a partnership, that the investor values based on the value it brings to their Net Income. TIBE is a phrase invented by One Power to distinguish its unique structure from the broad class of tax equity.

One Power offers only one kind of TIBE structure: the fixed allocation flip. This is the most conservative (and long-standing) structure available to separately allocate I&T value from cash value.

One Power offers only one kind of TIBE structure: the fixed allocation flip.

Technical Concepts:

1. In a structure taxed as a partnership (as our SPEs are), the profits, losses, and credits (PL&C) must be allocated in the same ratios to the same owners. If an owner is allocated 90% of the profits, that same owner must also be allocated 90% of the credits.

2. Cash distributions do not have to be allocated in the same ratio as PL&C. One owner can receive 10% of the cash and 80% of the PL&C.

3. A Limited Liability Company is used as the Special Purpose Entity (SPE) to own the project, and then the operating agreement for the SPE defines the rules of the SPE including the allocation of PL&C and cash.

The Roles:

In the One Power TIBE structure, there are three owners: The TIBE Investor, the Manager, and the Yield Investor. The TIBE investor is trying to maximize the I&T returns for their company. The Manager functions as the long-term manager of the SPE in exchange for equity. The Yield Investor is looking for long-term cash-on-cash yield.

The One Power family of companies was built to facilitate this investment structure.

• One Energy Capital LLC is the SPE manager.

• One Energy Capital Corporation is the fundraising arm and is the Yield Investor.

• The TIBE investor is an outside company or high net worth individual with a large tax liability.

How It Works:

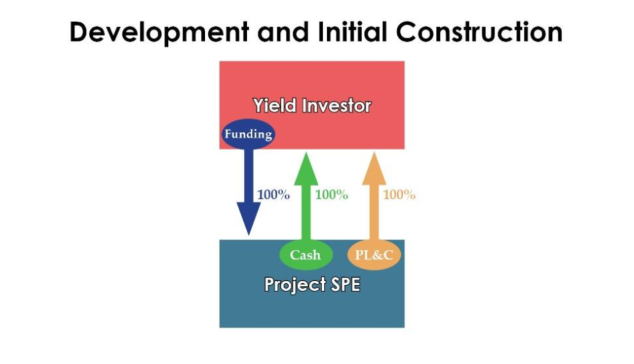

One Energy Capital Corporation owns and funds the SPE (as a disregarded entity) through development, engineering, procurement, and most of construction. As construction nears completion, the SPE brings in the Manager and the TIBE investor to fund the final stages of the project.

The exact ratios are published in each deal document, but typically the Manager gets 2% of the cash and 1% of the PL&C; the TIBE investor gets 95% of the PL&C and 3% of the cash; and the Yield Investor gets 1% of the PL&C and 95% of the cash. Cash ratios for the TIBE investor vary from 3-6% depending on specific deal economics. In order to optimize the value of a deal, some deals will have 2 “flips.” These ratios are governed by each SPE’s operating agreement. Details are published in each project’s allocation table (see below).

After a fixed time period, typically 66 months, the distribution ratios automatically flip.

All parties agree not to sell their units in the SPE for the first 66 months. After that period, the investors can choose to sell their units or keep their units.

The structure is attractive because in the first 66 months, the SPE generates the most I&T returns.

For further technical information and important TIBE details, please view our PPM or contact One Power directly.

Offerings

TIBE offerings are solely made pursuant to Rule 506(c) of Regulation D to promulgate under the Securities Act of 1933, as amended. They are available only to Companies and Accredited Investors (as defined by Rule 501 of Regulation D). Typically a company or an individual needs to have more than $5,000,000 in annual tax liability in order for TIBE investments to be attractive. TIBE offerings may be generally solicited; however, all investors will be required to demonstrate that they are Accredited Investors. For high net worth individuals, One Power will only accept a letter from a CPA that evidences an investor to be an Accredited Investor. No other form of verification will be accepted for individuals.

Offerings are made solely through Private Placement Memoranda to Accredited Investors (as defined by Rule 501 of Regulation D).

There are no open offerings at this time. Accredited Investors may Contact Us to get information on future TIBE offerings.

Resources

Finding the resources to educate yourself on tax equity can be daunting. To help, we’ve created an online data room with all relevant IRS notices, guidance, U.S. code, and other references on the topic. We used these resources when creating TIBE, and want to make them easily accessible.