INTRODUCING: WIND FOR INDUSTRY

One Power Company’s energy solution is Wind for Industry projects.

A Wind for Industry project consists of one or more large wind turbines installed on-site at a large industrial facility. The wind turbine(s) are interconnected to the facility’s side of the meter, so the energy from the turbines goes directly to the facility without passing through the electrical grid. The wind project operates in parallel to the grid so the industrial facility remains connected to the grid at all times.

WHAT’S ON THIS PAGE

Video FAQ

Head of Project Planning and Technology, Jessica Grosso, discusses turbine size.

When we say “large wind turbines” we mean a wind turbine with a nameplate rating of 3.0 – 4.5 megawatts that has a hub height of 260 feet or higher and a maximum tip height of more than 400 feet. These are the same size as the turbines on big wind farms.

When we say “large industrial facility” we mean a facility that consumes more than 4,000,000 kilowatt-hours a year. Typically, this is a facility larger than 200,000 square feet or a factory that does one or more energy-intensive activities (for example welding, cooking, freezing, or stamping). Often these facilities employ 100+ people.

In other words: A Wind for Industry project means big wind turbines for big industrial facilities.

We believe we are currently the largest installer and operator of behind-the-meter wind energy in the United States.

Wind for Industry projects enable customers to be more independent from the grid, save on their electricity bill, reduce their tier 2 emissions, and increase their long-term competitive advantage by having predictable energy rates for decades. A Wind for Industry project enables customers to control their own future.

Project Delivery Methods

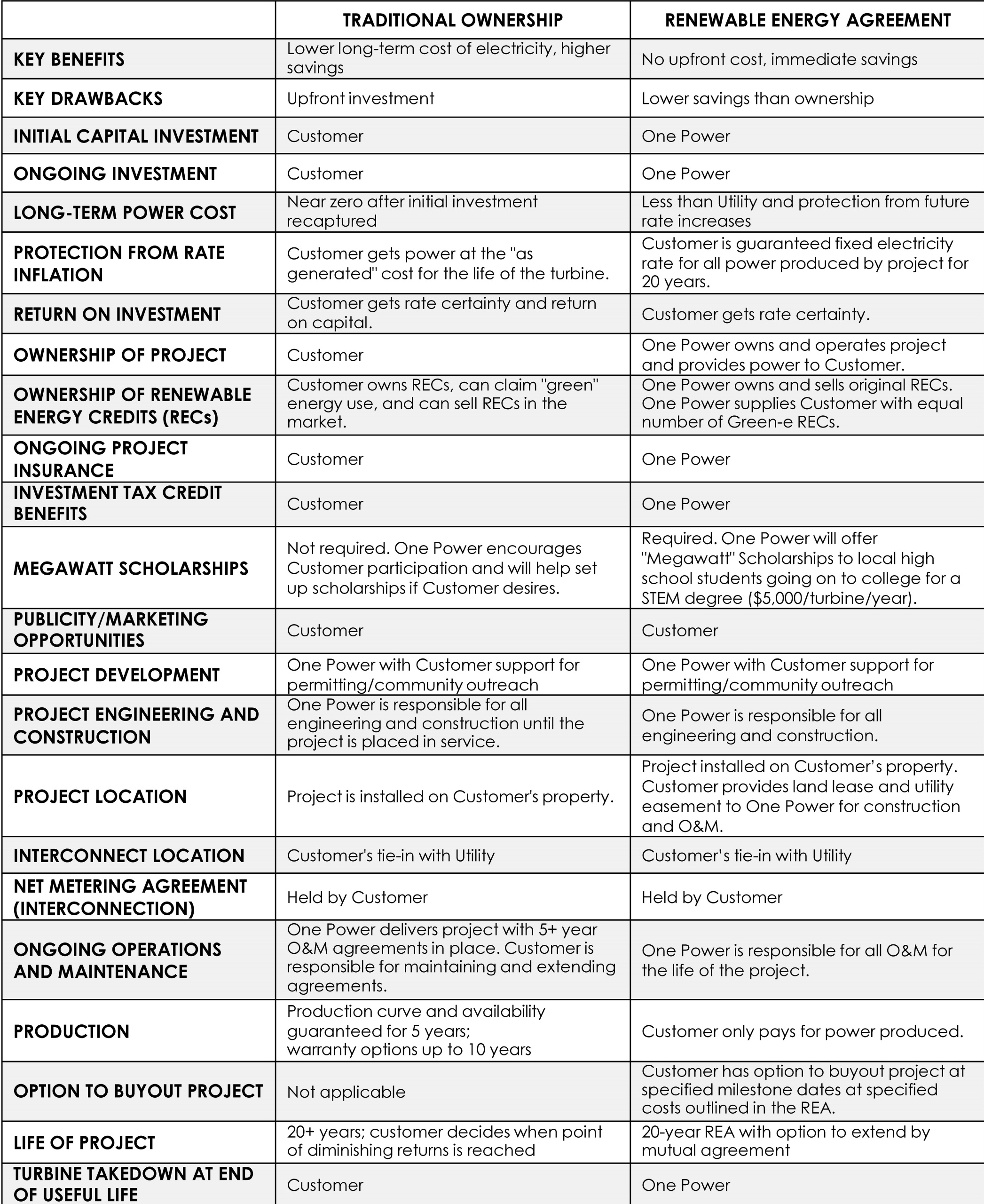

Every company has their own way of operating and their own financial goals. With that in mind, One Power Company offers two project delivery methods for Wind for Industry projects: CAPEX and Renewable Energy Agreement (REA).

In a capital expenditure or CAPEX project, One Power acts as the turnkey developer, engineer, procurement agent, contractor, and operator (DEPCO) for the project. We do all the work and the customer pays for the project upfront. After construction is complete, OPC continues to operate the project on the customer’s behalf for the lifetime of the project, and the customer pays for the operating costs. The customer has title to the project and the energy the turbines produce is owned by the customer.

In a CAPEX project, the customer pays upfront and owns the energy the turbines produce.

The Renewable Energy Agreement Explained

A Renewable Energy Agreement (REA) is One Power’s version of a Power Purchase Agreement (PPA). Our REA is an original document developed in-house, so it may differ from other PPAs you’ve seen. We designed it to be fair and easy to understand. In our REA, One Power takes all the financial risk to develop and operate the project. The customer agrees to buy all the power we produce over the term of the REA.

Read a generic Renewable Energy Agreement.

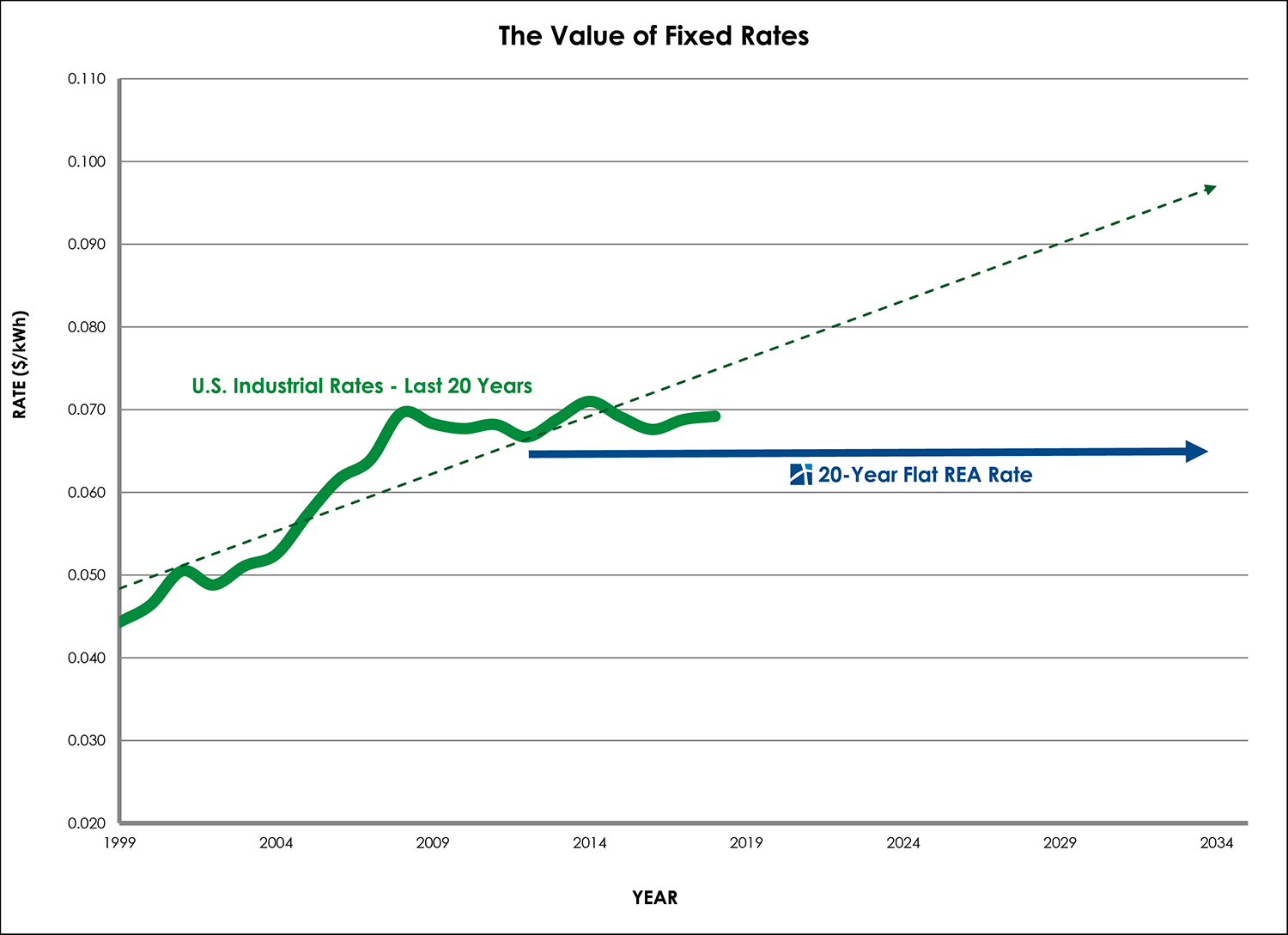

The rate in the REA is fixed for the entire term. That means on the day the REA is signed, the customer knows the cost of power for 20 years. We typically offer customers a flat rate for the 20-year duration, and we’re sometimes able to shape the rates over time based on the customer’s goals. In the past, for example, we have adapted the rate to be declining at a fixed amount, to have a lower introductory period, or to have a fixed escalator. In all cases, there are no market adjustments or variable inflators. The rates are all spelled out and locked in for the entire term on day one. That is the kind of long-term predictability a wind energy project can provide that no traditional fuel project can ever deliver.

The REA is intended to be a service contract and not a lease under GAAP. It may or may not be a lease under different state laws and it may be permitted in states where traditional PPAs are not.

The REA deliberately does not require a lot of the complicated credit enhancement mechanisms that more traditional PPAs have required over the years. One Power conducts a more sophisticated underwriting than simply a credit rating, and we work with businesses we believe in for the long run. The best testament to this agreement is that the REA form has been used by all our customers, which include multiple Fortune 500 companies.

We wrote an REA that, if the roles were reversed, we would feel comfortable signing.

Wind for Industry Project Basics

- The project is sited on the customer’s land or land that is contiguous to the customer.

- Either the customer or OPC will own the land the turbines sit on.

- The project interconnects to the customer’s system at their plant high voltage distribution voltage (typically 4,160 volts, 12,470 volts, or 34,500 volts).

- The customer is connected to both the grid and the wind turbines at all times – so the customer uses power from the wind turbines first, but it is always able to draw power from the grid.

- A Wind for Industry project can be as small as 1.5 megawatts and as big as 20 megawatts. For very large facilities, we have explored Wind for Industry projects of more than 100 megawatts. Wind for Industry projects are sized to provide 20-75% of a customer’s energy requirements.

- Typically, the collection system for a project is underground as much as possible.

Wind for Industry Project’s Value Proposition

- One Power Company’s projects historically provide a 5-15% immediate rate savings for customers. This reduced rate is typically locked in flat for 20 years.

- Projects are sized to offset a material portion (but not all) of a facility’s energy needs.

- Projects produce emission-free energy to directly power industrial facilities for 20 years and significantly reduce their dependence on the grid.

With each project, customers reduce their energy costs, their energy cost risk, and their carbon footprint. If they are an REA customer, they do all of this without using their own capital.

Wind vs Other Technologies

If you are considering a Wind for Industry project, then you have likely thought about solar, cogeneration, and other distributed generation technologies. While each has their pros and cons, our experience has been that if a Wind for Industry project works for your facility, it will always be the lowest-cost solution.

In addition, unlike hydrocarbon-reliant technologies like cogeneration and fuel cells, wind turbines operate with zero emissions and with zero ongoing fuel risk. Wind provides a significantly better long-term risk and environmental profile behind the meter than hydrocarbon-reliant systems.

Renewables offer obvious carbon-emission benefits. Unfortunately, what qualifies as renewable has become skewed by technologies trying to syphon off some of the market rushing to renewables.

A true renewable resource has free and infinite fuel. The fuel costs nothing and will exist forever. A pleasant side effect is most true renewables happen to be emission-free.

In distributed generation applications, renewables offer one very important distinction: free fuel eliminates all future fuel-rate uncertainty. Cogeneration, fuel cells, and other fuel-dependent resources are subject to wild swings in market prices over the next 20 years. Natural gas may be inexpensive now, but 10 years ago its cost was more than $7.50/MMBtu.

National Industrial Energy Rates (Source: EIA)

With environmental laws constantly evolving, world markets impacting demand, emerging markets growing in demand, and pipeline congestion increasing, all fuel-dependent markets have significant long-term risk. This risk explains why it’s nearly impossible to see fixed rates for more than five years in natural gas contracts.

Wind projects typically produce two to three times more energy per megawatt than solar projects and require far less land per megawatt.

On-site wind energy generation has no fuel-cost risk. The wind is free today and it will be free 20 years from now. That value proposition adds significant value for customers who are looking for long-term stability and rate protection. One Power ‘s operating costs are generally predictable.

Wind projects typically produce two to three times more energy per megawatt than solar projects and require far less land per megawatt.

The History of On-Site Generation and Wind for Industry Projects

Until recently, manufacturers were not willing to sell small quantities of wind turbines and general contractors were not interested in constructing one- or two-turbine jobs. The pricing structure, engineering design, and profitability of successful large-quantity turbine farms were not easily transferable to small-quantity wind projects.

One Power began breaking down these market barriers in 2009. Since then, we have delivered project after project, bringing down the installed cost of a Wind for Industry project by more than 40%. We have standardized the solutions and solved the problems that made projects like this nearly impossible. When we added our REA in 2014, we enabled companies to consider a Wind for Industry project without making the huge capital investment that was previously required. By putting the power in the hands of the consumer, we have formed valuable customer relationships with companies who felt left in the dark by their utility.

We did not invent wind energy; we just made it more accessible.

We’re working hard to make wind hassle-free. We look forward to the opportunity to earn your trust and your business.

We didn’t invent wind energy; we just made it more accessible.

Corporate Value #5: Make Wind Hassle-Free.