MARKET STUDIES

How big is the Wind for Industry market? Good question.

Review our U.S. Market Analysis and you’ll get an idea of the enormous market potential for Wind for Industry in the continental United States.

WHAT’S ON THIS PAGE

Wind for Industry 2020 U.S. Market Analysis

One Power’s United States Market Analysis was performed to quantify Wind for Industry’s market in the continental United States.

This market analysis consists of four components: the Total Addressable Market (TAM), the Serviceable Market (SM), Serviceable Market Growth, and Wind for Industry’s Expansion Strategy. The results of this report indicate there is a significant nationwide market for Wind for Industry, given One Power’s current business model.

Total Addressable Market Analysis

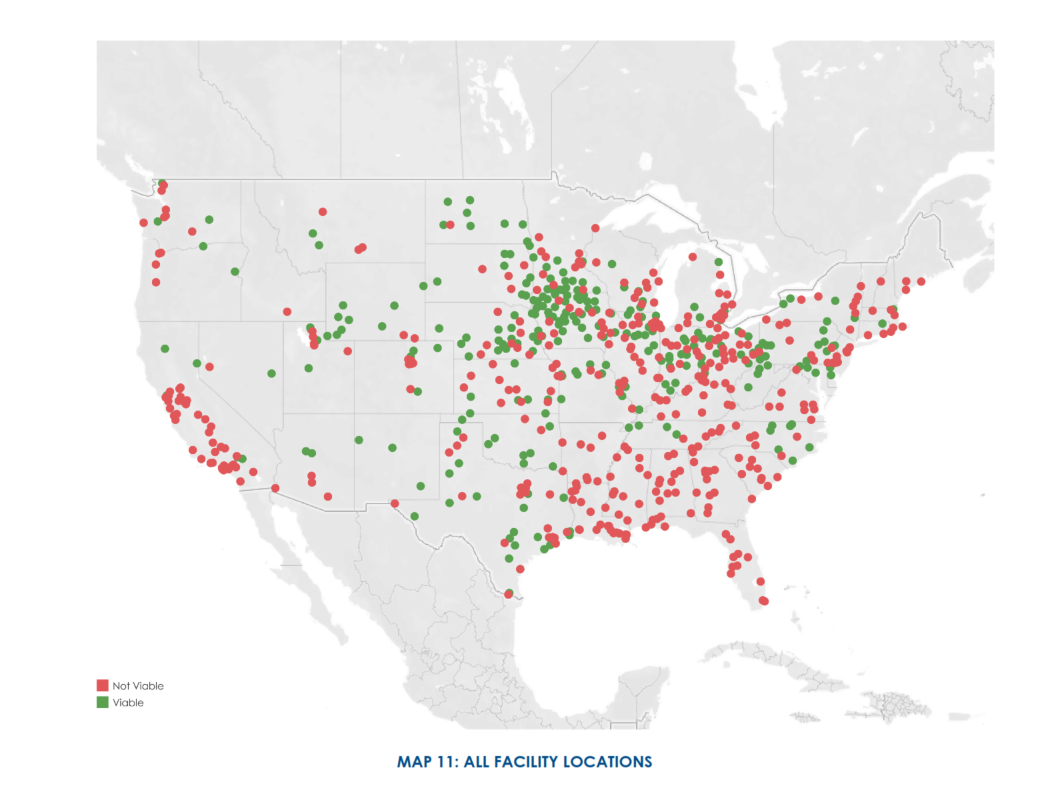

Wind for Industry’s market is made up of the nation’s large energy users, which are typically C&I customers. The TAM identifies customer facilities that are technically viable based on the unique requirements of utility-scale wind projects.

One Power performed site-specific screenings to estimate the ratio of C&I facilities that are technically viable in the U.S. Using this viability ratio, estimating project sizing and cost, One Power was able to estimate the total deployable capital of the Total Addressable Market.

Serviceable Market (SM)

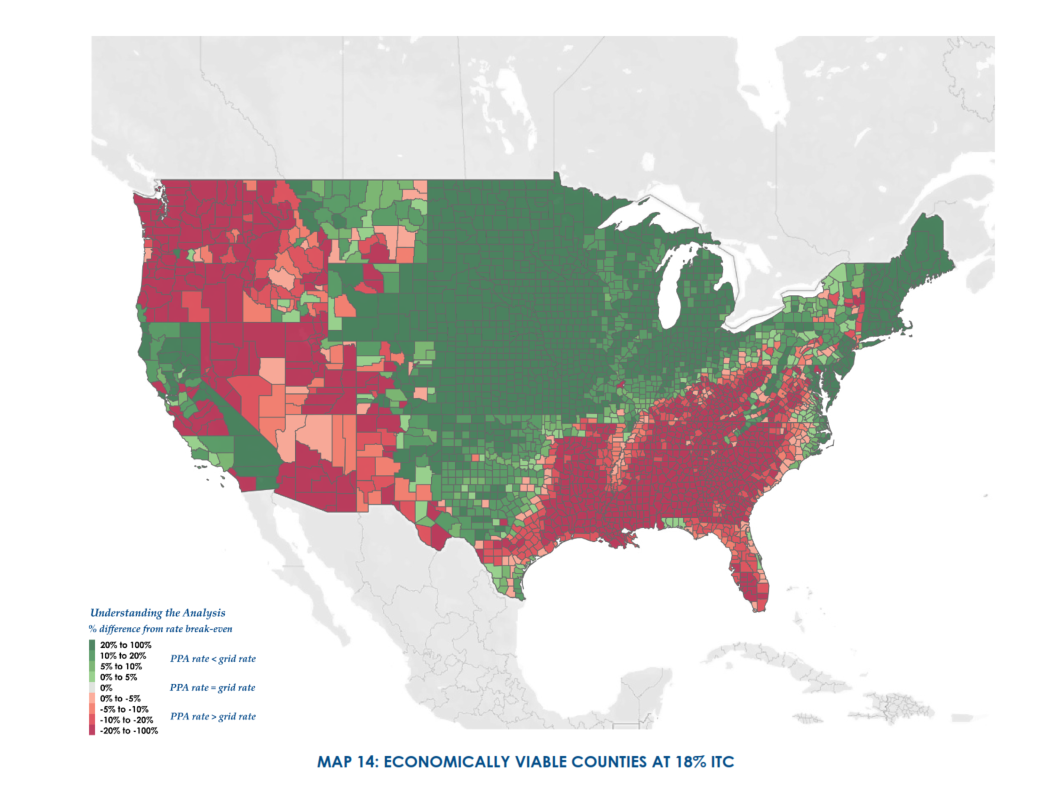

One Energy’s Serviceable Market (SM) is the segment of the TAM where Wind for Industry projects are economically viable. The SM identifies the locations where One Power could offer the customer a lower PPA rate than the average industrial grid rate, making Wind for Industry a more attractive energy alternative. One Power believes costs is the single biggest driver of customer decisions; thus price is the distinguishing factor in the Serviceable Market.

Serviceable Market Growth

The Serviceable Market Growth analysis explores how the Serviceable Market could be impacted by the phase-out of the Investment Tax Credit, and how One Power will adapt and improve its business model. There are three areas of business-model improvement One Power expects: higher turbine efficiency, greater project cost efficiency, and higher grid rates.

Key Takeaways

The key takeaways from the analysis include:

1. The Wind for Industry Serviceable Market in the continental U.S. is estimated at $66 billion in deployable capital based on a 0% Investment Tax Credit under current business model conditions (35,825 MW).

2. With a 30% Investment Tax Credit, the Serviceable Market nearly doubles to $120 billion (65,345 MW).

3. The Energy Intensive Sectors including Biodiesel, Cement Production, Ethanol Production, and Refining represent a $3.4 billion market for deployable capital without any Investment Tax Credit (1,865 MW).

4. As economies of scale and known technology improvements become fully effective, the Wind for Industry Serviceable Market will increase to $95 billion in deployable capital without any Investment Tax Credit (57,185 MW).

5. Approximately 20% of large C&I facilities will be able to have a technically viable and financially attractive Wind for Industry project as the industry reaches maturity.

6. The Investment Tax Credit is not critical to the success of the Wind for Industry market.

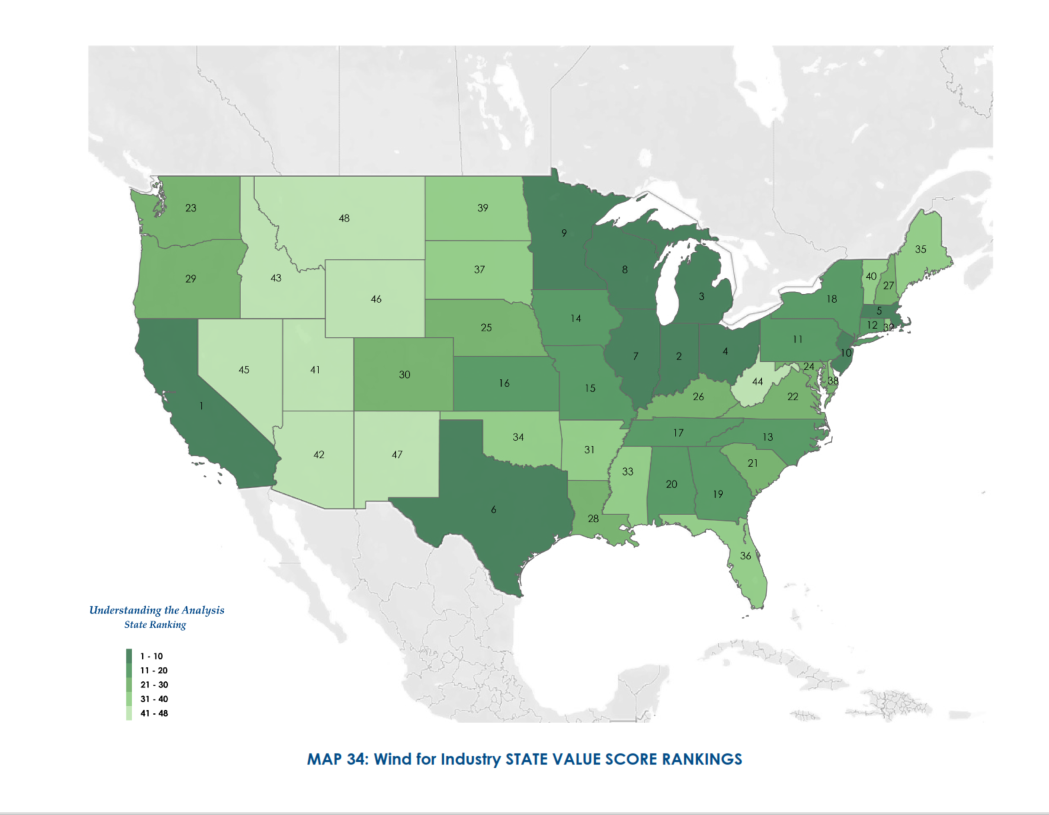

7. Wind for Industry’s potential has a sizeable concentration in the Midwest states of Minnesota, Wisconsin, Illinois, Indiana, Michigan, and Ohio. These states are known for having a large manufacturing presence and good wind resources.

Selected Maps